Earning cash as a business is exciting. However, let’s put the brakes on for a second before you immediately recognise that revenue. Has your business actually “earned” that revenue?

Revenue recognition has been a hot topic for the past several years thanks to the dual release in 2014 of the International Financial Reporting Standard (IFRS) 15 ‘Revenue from Contracts with Customers’ and the Accounting Standards Codification (ASC) 606 in the United States.

Released by the Financial Accounting Standards Board (FASB) as a part of Generally Accepted Accounting Principles (GAAP) in the U.S., ASC 606 standardised how companies should recognise revenue, particularly in incidents when the nature, certainty and timing of revenue might be complicated. As part of a broad effort to converge revenue standards across multiple regions including the U.S., the International Accounting Standards Board (IASB) released similar guidance designed to work in harmony with the ASC 606 standard as a part of the International Financial Reporting Standards (IFRS) framework to dictate when revenue can be considered earned and the financial statement accurately updated. This was encapsulated in the IFRS 15 standard, which has since been adopted by many countries around the world. Asia Pacific (APAC) businesses looking to learn more about IFRS 15 can find more information on the IFRS Standards Navigator or from your local accounting standard board.

Curious about when your company should recognise its revenue? Read on for the latest and greatest in our comprehensive revenue recognition guide.

What Is Revenue Recognition?

Revenue recognition is an accounting principle that asserts that revenue must be recognised as it is earned. So, the question becomes: when is revenue considered “earned” by a company? Revenue is generally recognised after a critical event occurs, like the product being delivered to the customer.

Key Takeaways

- Revenue recognition standards can vary based on a company’s accounting method, geographical location, whether they are a public or private entity and other factors.

- The revenue recognition principle, a key feature of accrual-basis accounting, dictates that companies recognise revenue as it is earned, not when they receive payment.

- Accurate revenue recognition is essential because it directly affects the integrity and consistency of a company’s financial reporting.

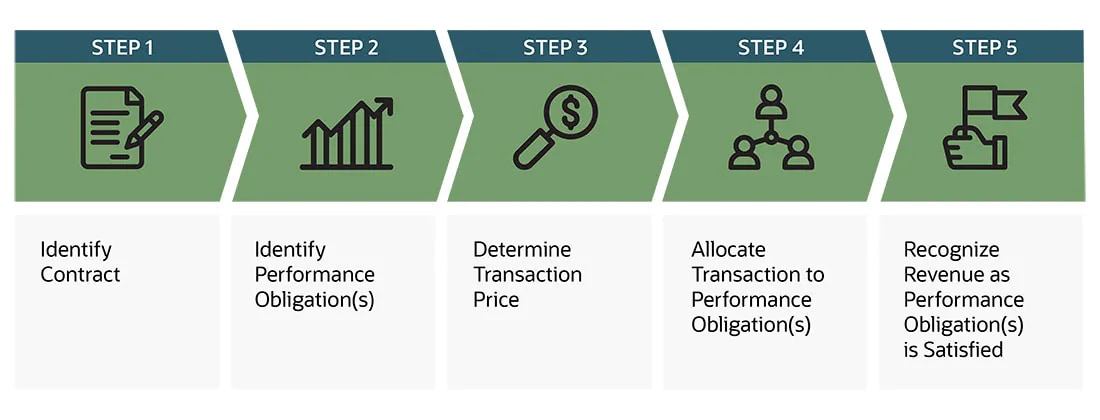

- In order to standardise processes around revenue recognition, the FASB released ASC 606, which provides a five-step framework for recognising revenue.

- IASB subsequently collaborated with the FASB and issued the internationally recognised IFRS 15, Revenue from Contracts with Customers standard. This adopts the basic five-step framework laid out in the ASC 606 model.

Revenue Recognition Explained

In essence, revenue recognition looks to answer when a business has actually earned its money. Typically, revenue is recognised after the performance obligations are considered fulfilled, and the dollar amount is easily measurable to the company. A performance obligation is the promise to provide a “distinct” good or service to a customer. On the surface, it may seem simple, but a performance obligation being considered fulfilled can vary based on a variety of factors.

The revenue recognition principle is a key component of accrual-basis accounting. This accounting method recognises the revenue once it is considered earned, unlike the alternative cash-basis accounting, which recognises revenue at the time cash is received. In the case of cash-basis accounting, the revenue recognition principle is not applicable.

Essentially, the revenue recognition principle means that companies’ revenues are recognised when the service or product is considered delivered to the customer — not when the cash is received. Determining what constitutes a transaction can require more time and analysis than one might expect. In order to accurately recognise revenue, companies must pay attention to the five steps laid out in both the ASC 606 model and the IFRS 15 standard, and ensure they are interpreting them correctly. More on the Five-Step Model later.

Why Is Revenue Recognition Important?

Proper revenue recognition is imperative because it relates directly to the integrity of a company’s financial reporting. The intent of the guidance around revenue recognition is to standardise the revenue policies used by companies. This standardisation allows external entities — like analysts and investors — to easily compare the income statements of different companies in the same industry. Because revenue is one of the most important measures used by investors to assess a company’s performance, it is crucial that financial statements be consistent and credible.

Revenue Recognition Examples

To better understand revenue recognition, let’s walk through two examples of companies with different business models.

-

Example: Subscription Service

The popularisation of the subscription model presented some revenue recognition challenges. Instead of a one-time transaction, subscription models presented a variety of ways to pay – annual, quarterly, monthly, etc. With different standards existing dependent on industry, the IFRS decided to standardise the process across various regions by adopting the five-step model for recognising revenue that was pioneered by FASB with the introduction of the ASC 606 model. The five steps laid out in the model are used to identify specific contractual obligations with their associated pricing and to define how revenue will be recognised. For example, a coffee subscription company charges $25 a month to send a sampling of ground coffees to its subscribers. It also charges a one-time $50 startup fee for the process of learning more about the consumer, creating a curated selection of coffees and sending a pour-over coffee maker as a part of the subscription program. Once the initial process is complete (i.e., the consumer has completed the questionnaire, the company has created a curated plan and the pour-over coffee maker has been delivered), that $50 can be recognised. The recurring fee, however, is charged on the first of each month even though the coffee itself is not delivered until mid-month. The company cannot recognise that $25 recurring payment when they receive it, as the business has not technically earned it yet.

Because the startup process has been completed, that revenue can be recognised as earned. However, since the monthly service has not yet been delivered, the accounting ledger must reflect that. Thus, the revenue is deferred. At the end of the month, when the business has delivered both the startup process and the monthly service, the ledger can be updated to reflect the newly recognised revenue.

Let’s look at another relevant situation here. A current consumer decides to opt into the annual coffee subscription plan, meaning that they pay for 12 months of the service at a discounted upfront cost of $264 ($22/month). The coffee company cannot recognise that $264 upfront, as it has not delivered the service/product. Instead, the business will recognise the $22 each month after the consumer receives their coffee sampler.

-

Example: Independent Contractors

Independent contractors also face a perplexing accounting situation, because when they are paid often varies. As an example, let’s say an independent digital design agency is hired by a startup. The startup agrees to pay the contractor for three performance obligations: website creation, logo design and digital ads ($12,000, $4,500 and $3,500, respectively). The agency will be paid after each product is delivered. The digital design company’s ledger, because it has not earned the revenue yet, would first display as such:

The agency completes and delivers the website in the first month, leading to a ledger update – even if they have not been technically paid by the client yet. As soon as it’s delivered, the performance obligation is considered fulfilled.

In the following month, it finishes and delivers the logo designs.

In the third month, the digital ads are done and delivered, so the agency has fulfilled its performance obligations. Thus, the remaining revenue can be recognised. Again, this can be recognised even if the startup hasn’t technically paid them yet. The performance obligations have been fulfilled, meaning the revenue can be recognised.

Conditions for Revenue Recognition

Conditions for revenue recognition differ based on a company’s geography, business model, whether it is a public or private entity, its bank, investors and numerous other factors.

However, for companies operating in the APAC region, the standards set by the IFRS provide the overarching framework and guidance when it comes to recognising revenue. Some 144 countries have mandated the IFRS standards, with the relevant accounting practices in each applicable region a legal requirement for financial institutions and public companies.

Many companies in regions where the IFRS standards are not mandated voluntarily follow IFRS guidelines, even if the predominant model may be dictated by a different mandated standard. In the U.S., for example, public companies are required to follow GAAP standards, while in Japan, the J-GAAP standard is used. This means that global companies with entities in APAC and other regions where IFRS standards are mandated may report back to parent companies that typically employ the GAAP standard

IFRS Reporting Standards Criteria

According to IFRS criteria, the following conditions must be satisfied for revenue to be recognised:

- Risk and rewards have been transferred from seller to the buyer.

- Seller has no control over goods sold.

- The collection of payment from goods or services is reasonably assured.

- Amount of revenue can be reasonably measured.

- Cost of revenue can be reasonably measured.

These criteria fall under three buckets that the IFRS lists as necessary for a contract to exist: performance, collectability and measurability. The first two criteria listed are classified under “performance.” Performance is achieved when the seller has done most or all of what it is supposed to do to be entitled to payment. The third is a “collectability” condition, which means that the seller must have a reasonable expectation of being paid. The last two are considered “measurability” conditions because of the matching principle: the seller must be able to match expenses to the revenues it helped earn. Therefore, the amount of revenues and expenses should both be reasonably measurable.

Revenue Recognition Requirements

Organisations in many parts of the world, including much of the APAC region, require IFRS 15 for domestic public companies. It is also a popular accounting standard for many private companies in the region.

IFRS 15, which was issued in 2014 and made effective for annual reporting periods beginning on or after 1 January 2018, applies to all contracts with customers, although there are some exceptions.

For example, the standard does not cover financial instruments and other contractual rights or obligations within the scope of IFRS 9 ‘Financial Instruments’ or IFRS 10 ‘Consolidated Financial Statements’.

Moreover, in some circumstances, a contract with a customer may be partially within the scope of IFRS 15 and partially within the scope of another standard. You can find more about these exceptions on the IFRS Standards Navigator or from your local accounting standard board.

Five-Step Model for Recognising Revenue – IFRS 15

While guidance already existed for contracts, the rules varied and were somewhat subjective. In response, the International Accounting Standards Board (IASB) introduced IFRS 15 in May 2014 to provide a uniform comprehensive revenue recognition model for all contracts with customers. This was in line with FASB’s ASC 606 revenue standard in the U.S., which was also issued in May 2014. The updates aimed to establish some guidance around contracts, as well as some clarity and standardisation around the entire revenue recognition process by replacing different industry and transaction-specific guidelines with a five-step framework:

-

Identify Contract With Customer:

In order to complete this step, the parties must fulfill several criteria. All parties must first approve of the contract and be committed to fulfilling their obligations. The contract will outline each party’s rights as well as the payment terms regarding the goods or services to be transferred. It also must have “commercial substance.” This means that both sides expect the future cash flows of a business will change as a result of the transaction. Lastly, collectability must be probable. This means that payment is likely to be received (i.e., the customer’s credit risk should be evaluated at contract inception).

-

Identify Performance Obligation(s):

In this step, an entity must identify all distinct performance obligations. A performance obligation is a promise in a contract to transfer a good or service to the customer. There are two criteria for a good or service to be considered distinct, and both of those criteria must be met.

- A good or service is capable of being distinct if the customer can benefit from it on its own or with other resources that are readily available.

- A good or service must also be separately identifiable from other promises in the contract to be considered distinct — commonly referred to as being “distinct in the context of the contract.”

-

Determine Transaction Price:

This part of the process entails determining the amount of consideration the entity expects to be entitled to, in exchange for transferring promised goods or services to a customer (i.e. the transaction price). In many cases, this step is straightforward, as the seller will receive a fixed amount of cash simultaneously with the transferred goods or services. However, effects from several factors can complicate the determination:

- Variable considerations: When there is uncertainty around the amount of consideration, like in instances of discounts, rebates, refunds, credits, incentives and similar items. If the consideration is variable, an entity can estimate the amount of consideration to which it will be entitled in exchange for the promised goods or services.

- Constraining estimates of variable consideration: After estimating variable consideration, entities must assess the likelihood and magnitude of the potential revenue reversal (due to factors like market volatility).

- The existence of a significant financing component: When there is more than a year between receiving consideration and transferring goods or services, a contract may have a significant financing component. A financing component in the transaction price considers the time value of money.

- Non-cash considerations: When a consumer pays in the form of goods, services, stock or other non-cash consideration.

- Considerations payable to the customer: Instances where a company must also make a payment to a consumer like slotting fees, cooperative advertising, buydowns, price protection, coupons and rebates.

-

Allocate Transaction to Performance Obligation(s):

If a contract has more than one performance obligation, a company will need to allocate the transaction price to each separate performance obligation based on its relative standalone selling price.

-

Recognise Revenue as Performance Obligation(s) is Satisfied:

The final step is to recognise revenue when or as the performance obligations in the contract are satisfied.

-

Transfer of Control: When a customer obtains control over the asset, it is considered transferred and the company’s performance obligation is considered satisfied. The company can then recognise that revenue.

-

Performance Obligations Satisfied Over Time: As a company transfers control of a good or service over time, it satisfies the performance obligation and can recognise revenue over time if one of the following criteria is met:

- The customer receives and consumes the benefits provided by the entity’s performance as the entity performs.

- The entity’s performance creates or enhances an asset (for example, work in progress) that the customer controls as the asset is created or enhanced.

- The entity’s performance does not create an asset with an alternative use to the entity (see IFRS 15:35), and the entity has an enforceable right to payment for performance completed to date.

An example of performance obligations being satisfied over time would be a routine or recurring cleaning service. The customer will receive the benefit of the vendor’s cleaning service as it’s being performed simultaneously.

-

Performance Obligations Satisfied at a Point in Time: If a performance obligation is not satisfied over time, the performance obligation is satisfied at a point in time. To determine the point in time at which a customer obtains control of a promised asset and the company satisfies a performance obligation, it should consider guidance on control and the following indicators of the transfer of control:

- The company has a present right to payment for the asset.

- The customer has legal title to the asset.

- The company has transferred physical possession of the asset.

- The customer has the significant risks and rewards of ownership of the asset.

- The customer has accepted the asset.

For example, an online ecommerce store sends a shirt to a customer. That customer has 30 days after receipt to return the shirt if needed. The company will consider the performance obligation fulfilled and the 30 days has passed.

-

Measuring Progress Toward Complete Satisfaction of a Performance Obligation: For each performance obligation satisfied over time, a company should recognise revenue over time by measuring the progress toward complete satisfaction of that performance obligation. Methods for measuring progress include the following:

-

Output Method: Outputs are goods or services finished and transferred to the customer. A company first estimates the amount of outputs needed to satisfy the contract. The entity then tracks the progress toward completion of the contract by measuring outputs to date relative to total estimated outputs needed to satisfy the performance obligation. Number of products produced or services delivered are both examples of output measures.

-

Input Method: Inputs are measured by the amount of effort that has been put into satisfying a contract. The input method is implemented by first estimating the total inputs required to satisfy a performance obligation. The company then compares efforts to date with the estimated total needed to satisfy the performance obligation. For example, money, time and materials utilised are all input measures.

-

-

The revenue standard for public companies was initially scheduled to become effective for annual reporting periods beginning on or after 1 January 2017. In September 2015, IFRS deferred the effective date of IFRS 15, making the standard effective for annual reporting periods beginning on or after 1 January 2018, with earlier application permitted, depending on an entity’s financial reporting year. The standard applies to public, private and non-profit entities. Check with your local accounting standard board to find out more about how different types of entities are required to adhere to the standard.

IFRS Revenue Recognition Principles

Given the broad adoption of IFRS throughout APAC, IFRS 15 plays a big role in dictating how organisations in the region recognise revenue.

In the words of the IFRS Foundation, the core principle of IFRS 15 is that, “an entity recognises revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.”

An entity recognises revenue in accordance with that core principle by applying the five steps outlined earlier.

This principle ensures that companies in compliance with IFRS 15 recognise their revenue when the service or product is delivered to the customer — not when the cash is received.

Previous revenue recognition guidance in various regions around the world was immensely complicated. There were numerous and inconsistent requirements on how to recognise revenue, differing greatly across industries and geographies. This led the IASB, as the international financial standards body, to issue IFRS 15, and FASB, in the U.S., to release the aforementioned update to ASC 606. Together, the new standards replaced hundreds of different industry and transaction-specific guidelines with a basic, five-step framework. The intent is to provide more information around how to handle revenue recognition in contractual situations and offer an industry-neutral framework for improved comparability of financial statements.

The release of the IFRS 15 and ASC 606 standards has essentially achieved convergence between the U.S. GAAP and IFRS, with only some minor differences.

For companies of all sizes, both public and private, revenue recognition is an important concept to understand fully. It is critical for businesses to look strategically at revenue recognition policies to ensure they are compliant now and are conducive to the company’s future financing, filing and expansion goals. To that end, advanced financial management software will help you schedule, calculate and present revenue on your financial statements accurately, automating revenue forecasting, allocation, recognition, reclassification, and auditing through a rule-based event handling framework — whether your business conducts sales transactions that consist of products or services, or both, and, whether these transactions occur at a single point in time or across different milestones.

#1 Cloud

Accounting

Software

Revenue Recognition FAQs

Do small businesses need to understand revenue recognition?

Small businesses do need to understand revenue recognition and its associated principles. From a financing perspective, financial statements adhering to the respective standards across APAC that incorporate IFRS 15 are commonly understood by lenders and investors, providing credibility to the financial reporting and the company as a whole. Thus, even in those instances where it may not be mandatory, having -revenue recognition practices and financial statements that comply with your region’s specific accounting standards can open up more financing options and sources, often at a lower cost — making it easier to build and expand a business. For companies that are considering going public eventually, already adhering to the respective standards that apply in your region can help ease the transition. When a private company goes public, the company will have a different ownership and capital structure, investors with varying investment strategies, generally more accounting resources and limited investor access to management. Therefore, the company must immediately meet the regulatory requirements in the market in which it is filing.

How does revenue recognition help my business?

Revenue recognition isn’t just for compliance purposes — it is of benefit for companies to recognise revenue in a consistent manner, as well. Internally, companies can review and compare their current financials with past ones without qualm, knowing that their revenue recognition policies have remained consistent. Following the standards for revenue recognition also allows for easy external comparison so businesses can quickly and easily gauge how they are performing relative to their competitors.