Beginner’s Guide to Lease Accounting

Use this lease accounting guide to learn about the types of leases, how to present them on financial statements, calculations and the changes in the laws. CPA and CVA Denise Hozza shares expert advice for operationalising the new standards.

Included on this page:

- Changes in FASB lease accounting

- How to operationalise the new accounting standards

- Accounting for a capital lease

- Accounting for operational lease

- Sale-leaseback

What Is Lease Accounting?

Lease accounting is the financial management of leases. Leases are contracts where the lessor grants the right to use their property, equipment or services to a lessee for an agreed amount of time and payment. The two most common lease types are operating and finance leases.

Leasing offers an advantage to a company’s cash flow. There is no large initial outlay of cash in a lease, as compared to a purchase, as many leases finance 100% of the cost. In that financing, many companies take advantage of the revenue that the financed item brings to pay their lease payments. Other benefits of a lease can include:

- More flexible payment schedules.

- Potential for improved equipment management and maintenance.

- Reduced equipment obsolescence due to easier replacement.

- In some cases, the lease and associated liability may not show on the company’s balance sheet.

One example of a lease relationship is that of a car dealership (the lessor) leasing a fleet of new cars to a business (the lessee). The company pays only a portion of the value of the vehicles monthly to the dealership and exchanges the cars with the dealership for new ones annually. Both businesses benefit from the arrangement: The company always has new, reliable cars for a stipulated monthly payment. The dealership makes a profit and can sell like-new (1-year-old) automobiles after the exchange.

Leasing also has some disadvantages to both the lessor and the lessee. The lessor cannot completely control when and if payment is made or how the lessee treats their property or equipment, even with strict contracts in place. Accountants call this separation of ownership and asset control the agency cost of leasing. For the lessee, the amount they pay for the equipment may be higher in a lease over time than purchasing the product outright. The owner of the equipment or property, the lessor, must make a reasonable profit margin to make their business relationship worthwhile.

Under Generally Accepted Accounting Principles (GAAP), in lease accounting, companies must identify all their leases, evaluate them to determine whether they still meet the appropriate model guidelines and properly account for each lease.

Operating vs. Financing Leases

There are two main types of leases, operating leases and finance leases, and a third related type, the sale-leasebacks. Finance leases, also called capital leases, allow the lessee to claim depreciation, while the operating lease may not show on the balance sheet.

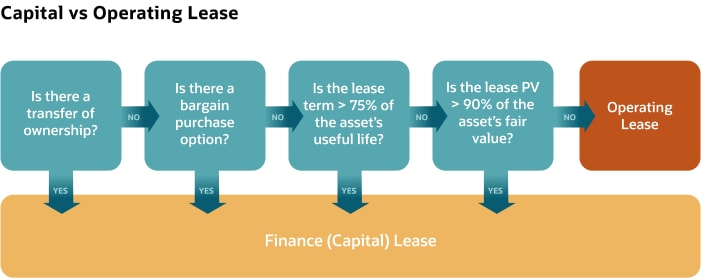

The classification depends on the transfer of risks and rewards from the lessor to the lessee, and the four bright-line criteria:

A fifth test determines whether the asset is so specialised that it has no alternative use for the lessor after the lease term. The Financial Accounting Standards Board (FASB) added this criterium with rule changes in 2016, but it’s not in the diagram because this would have most likely already triggered one of the other bright-line tests.

A company with a finance lease records an asset and its related liability on the balance sheet. It can deduct the computed interest component of the lease payments yearly on its income statement. It has full control of the asset it leased and is entirely responsible for its upkeep. In the direct-finance type of a finance lease, the lessor enters the sale on its books and removes it from its assets, creating a receivable for the interest payments.

Accounting for a finance lease has four steps:

- Record the present value of all lease payments as the cost of the lease.

- Record only the interest portion of each payment as an expense.

- Depreciate the recognised cost of the asset over its applicable life.

- Recognise the asset’s disposal upon its retirement.

Lessor Accounting for Capital Leases

Under U.S. GAAP, the lessor records a capital lease as a direct finance lease when the carrying value and the lease payments are the same. If the present value of the lease payments is more than the asset carrying value, then the lessor records a sales-type lease.

The lessor reports both types of finance lease on its financial statements in the following ways:

- Balance Sheet:

The lessor reports the lease receivable based on the present value of the lease payments. - Income Statement:

The lessor reports the interest revenue based on the lease’s receivables using the interest rate at the loan’s beginning. - Cash Flow Statement:

The lessor reports the interest component as operating cash flow and the principal part as the investing cash flow.

Finance (Capital) Lease Example

Skidz, Inc. agrees to lease a tower crane from Bob’s Construction Supply worth $1,100,000 for six years. The crane’s useful life is seven years. The contract specifies Skidz, Inc. will make the lease payment by the end of every month for six years with an implicit annual interest of 12%. At the end of the lease period, there is no salvage value, but Skidz, Inc. will have the option to buy the crane at a value less than the fair market value (FMV). Skidz will pay ~$20,000 monthly (actual = $19,886.56).

Based on the criteria for a capital lease, the contract meets the bright-line criteria:

- Bob’s Construction does not transfer the ownership of the crane to Skidz, Inc. during the lease.

- There is an option for Skidz, Inc. to buy the crane at less than FMV at the end of the lease.

- The lease term is 6/7 of the crane’s useful life (86%), more than the 75% requirement.

- The present value of the monthly lease rental is 94%, exceeding the 90% requirement.

At 94%, the present value for calculating the lease payments is $1,034,000. The total amount paid in rent over the term (72 months) is $1,431,832. Split this amount into the principal and interest charge to find the interest:

Accountants split the depreciation of the crane per month between the 72 payments. Therefore, the monthly depreciation of the crane is:

Under a capital lease accounting agreement, Skidz, Inc. pays to clear the finance lease principal and interest over the 6-year loan. The first period in the lessee’s books looks like this:

The second period will look like this:

Further breaking down a finance lease, there is the accounting for the sales-type lease and the direct financing lease. These leases are comparable in that they both have a lessor providing property and a lessee making regular payments to use that property, but dissimilar in their accounting. In the sales-type finance lease, the lessor accounts for a portion of the income when the lease begins and the remainder over the lease’s term. The lessor recognises the resulting profit or loss at the start of the lease. In the accounting of the direct finance lease, the lessor accounts for the income over time as the lessee makes payments.

A direct finance lease is similar to how a bank accounts for loans. Each month, the borrower makes the payment, and the bank recognises the interest portion as income and the principal portion as reducing the loan balance. A comparison of the accounting for sales-type and direct financing leases follows:

Lessor Accounting for Operating Lease

In operating lease accounting, the lessor reports the leased asset on the balance sheet and the interest revenue and the asset depreciation on the income statement. The lessor reports the lease payment as the cash inflow on its cash flow statement.

A company must meet the test for an operating vs. finance lease to qualify for an operating lease. The lessor should also know that an operating lease as compared to a finance lease usually means:

- It will have more cash flow in later years.

- It will have less cash flow in the early years.

- Its taxes are lower in the operating lease’s early years.

In an operating lease, the lessee must recognise:

- The total cost of the lease allocated over the lease term in a straight-line in each period.

- The variable lease payments that are not in the lease liability.

- Any right of use (ROU) asset impairment.

In operating leases, the lessor keeps all the benefits and responsibilities of the asset. The lessee uses the asset for only a part of its usable life.

Operating Lease Example

Trax, Inc. enters into an operating lease agreement for its warehouse space, paying rent of $17,000 for 12 months. As this is an operating lease, Trax, Inc. will show the lease on its books uniformly over the 12 months. Its monthly rental expense is:

The journal entry for this transaction:

For more information on finance and operating leases, see “Critical Lease Accounting Terms to Know for ASC 842/IFRS 16 Preparation.”

Sale-Leasebacks

Sale-leaseback (SLB) is when a company sells fixed assets such as property or equipment and then leases it back from the new owner. So, the seller becomes the lessee, and the purchaser becomes the lessor. SLBs are both finance and operating leases.

SLBs are beneficial to the company selling and leasing back because the company can free up some holdings and potentially gain off-balance sheet financing, meaning that its balance sheet looks more favourable. The criteria for an SLB includes:

- The ASC 842 and IFRS 15 lease accounting standards must recognise the sale transaction under

their revenue recognition standards. The sale must be a complete change of control of the

asset from the seller-lessee to the buyer-lessor:

- The seller-lessee must derecognise the asset.

- The buyer-lessor recognises a net investment and any profit or loss in the lease.

- The buyer-lessor recognises any indirect initial costs as an expense or defers them if applicable.

- The transaction must be at fair value or adjusted to fair value.

Sales-Leaseback Example

Honduya Co., a seller-lessee, sells an airplane to Spacey, Inc., a buyer-lessor, and immediately leases it back. The leaseback term is eight years, with no renewal possible. The other details of the sale and lease are:

This SLB is a straight-line lease expense and a successful sale. The payments and amortisation are:

Recording this sale and leaseback into journal entries:

Lease Accounting Standards Changes

In 2016, the FASB released a lease accounting standard update (ASU 2016-02) as Topic 842. Primarily, the new standard specifies that lessees identify ROU assets and lease liabilities on their balance sheets for almost all leases. For more information on ROU and lease liabilities, see “Critical Lease Accounting Terms to Know for ASC 842/IFRS 16 Preparation.”

Denise Hozza, Director at Concannon, Miller & Co., P.C., has worked in public accounting for 23 years.

She points out, “In the past, companies expensed the rent or lease payments on the income statement without it ever hitting the balance sheet in the form of an asset or liability.”

These lease accounting changes also mean that companies must capitalise most operating leases on the balance sheet, instead of just reporting them in the footnotes. On the income statement, companies must still identify leases as either operating or financing. Short-term leases, those that last shorter than 12 months, are exempt from this ruling. The new standard replaced ASC 840, closing the major loophole of off-balance sheet operating leases.

The new leasing standard took effect for public companies in January 2019, but several groups called for postponing the effective date for other issuers (private and small reporting companies). In May 2019, the American Institute of CPAs formally asked FASB to push back the effective date, calling lease accounting “significant and complex.” As a result of this effort, the new Financial Accounting Standards Board (FASB) and International Financial Reporting Standards (IFRS) lease accounting standards (ASC 842 and IFRS 16) will now take effect in 2021 for private and small reporting companies.

Hozza says that concerning the changes, the most critical to know is that “the new lease standards could severely affect a company’s debt covenants. The new requirement to record a liability for both financed and operating leases may make the company out of compliance for any of their calculated covenants based on their debt.”

Other changes include:

Companies show most of the rule changes on their balance sheets. Additionally, companies must ensure:

- The asset and liability are based upon the computed value of their lease payments.

- The present value calculation for the lease uses the discount rate or the incremental borrowing rate.

- If the lease is 12 months or less, then the lease is exempt from recognition as an asset and liability.

IAS 17 Changes to IFRS 16

The International Accounting Standards Board (IASB) implemented new lease accounting rules, IFRS 16, superseding IAS 17. These converge with the FASB’s GAAP lease accounting standards for lease commencement (called day one). Day two accounting of leases for IASB and FASB are slightly different from each other.

These new rules make it more complex for dual-reporting companies both in the United States and internationally. International rules are now transitioning to the single lessee accounting model. Dual reporters may need to maintain different processes and accounting systems to comply with varying frameworks.

The international and U.S. rule differences after day one are:

- The new IFRS 16 rules treat all leases as financing agreements.

- Under the U.S.’s ASU 2016-02, only finance leases are financing arrangements on the income statement. The lessee reports assets and liabilities on the balance sheet, but day two accounting will produce a straight-line total lease expense.

The key changes between the old international rules (IAS 17) and the new ones (IFRS 16) look like the changes in the U.S. rules:

IAS 17 Example

IAS 17 uses the concept of “substance over form” in lease accounting. For example, George Betts, Inc. chooses to lease a digger with four years of remaining useful life for $5,000 per year for four years (making a payment at the end of each year), instead of purchasing it for its $14,275 fair value outright. After four years, George Betts, Inc. will have paid $20,000 in rent and will turn the digger back into the leasing company. There will be no salvage value at the end of the lease. The finance cost is 15% per year.

According to IAS 17, this is a finance lease, since the asset will have no remaining useable life at the end of the 4-year lease. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use.

George Betts, Inc.’s journal entries for this lease are as follows:

The carryforward of the lease at the end of year one = (fair market value + interest) – annual rent = $14,275 + $2,141 (at 15%) – $5,000 = $11,416.

At the end of year two, the carryforward = (year one carryforward) + interest – annual rent = $11,416 + $1,712 (at 15%) – $5,000 = $8,128.

IFRS 16 Example

With few exceptions, IFRS 16 ends the distinction between operating and finance leases in financial statements of lessees. Using the same example from above, George Betts, Inc. chooses to lease a digger with four years of remaining useful life for $5,000 per year for four years (making a payment at the end of each year), instead of purchasing it for its $14,275 fair value outright. The finance cost is 15% per year. At the beginning of the lease, George Betts incurs both the initial direct costs of $960 and the lease liability of $14,275.

IFRS 16 requires the lessee to report the ROU assets and lease liabilities on its balance sheets.

Right of Use Asset and Lease Liability

Under ASC 842, for both finance and operating leases, the lease liability is on the lessee, who is required to make payments on its lease as measured on a discounted basis. The ROU is the asset that the lessee has the right to employ.

Calculate lease liability by finding the present value of the remaining lease payments and the present value of the amount due at the end of the lease in consideration of purchase or termination options. Calculate the ROU asset as the initial amount of the lease liability, plus any lease payments made before the lease began and any initial direct costs. Subtract any lease incentives received.

Lessees recognise the ROU asset and the lease liability at the beginning of a lease or when the asset is available to the lessee to use.

ROU Asset Example

Radicali Company signs a 3-year lease for its new building space with Eddy Corp. It pays the lease at the end of the year. Its lease payments are:

- Year 1- $100,000

- Year 2- $110,000

- Year 3- $125,000

The discount rate can be difficult to determine, but the company should calculate it at the rate implicit in the lease. For this example, the discount rate is 5.51%, so the present value for the lease payments is $300,000. Radicali Company expects to benefit from the ROU of the building evenly over the lease’s term. The journal entries for the lease commencement (day one) and the lease in years one, two and three looks like the following:

Calculate the interest expense as lease liability in year one as $300,000 from the commencement lease liability x the discount rate:

Calculate the amortisation expense and ROU asset in year one as $300,000 from the commencement ROU asset divided by the 3-year lease term:

Calculate the year two interest expense and lease liability as (the initial lease liability) – (the year one payment) + (the year one accretion) x 0.0551:

Calculate the year three interest expense and lease liability as (the initial lease liability) – (the year one payment) – (the year two payment) + (the year one accretion) + (the year two accretion) x 0.0551:

Overall, on the lessee’s balance sheet for its 3-year lease, there are the following assets and liabilities.

How to Plan for Lease Accounting Rule Changes

FASB intends its updated lease accounting standards to increase transparency and comparability in different organisations through implementing ASC 842. Preparing for this change may require some companies to adjust their current lease agreements. At a minimum, they need to start reviewing all their contracts.

For companies that want to operationalise the new standards, Hozza recommends,

“First, understand the new standards. Then determine which leases you will have to record properly. If a lease’s term is shorter than a year, then this standard does not apply. But, if a company has a lot of leases, they will have to plan how to record the transactions to be compliant with the new standard.”

Next, she recommends,

“Review all service agreements and evaluate them in case there are portions which would fall into the definition of a lease, and someone needs to carve them out from the overall contract.”

There may be embedded leases that the company should pull out. Embedded leases are those that are within service agreements. Both parties should decide if the contract has a lease in it.

Regarding operationalising changes in financial documents, Hozza recommends that companies “examine their lease documents to see if they fall under either finance or operating leases. Then, they must document the lease terms to record them accurately.”

Other recommendations for companies to plan for changes in the lease accounting rules include:

- Determining if their existing technology can help organise their change process.

- Performing a lease data gap analysis with the old standards and the new standards.

- Developing an implementation roadmap.

- Preparing timelines and action plans for the changeover.

- Applying the standards early.

- Identifying a transition team within the organisation.

- Explaining to stakeholders the company response and the rule changes.

Build-to-Suit Lease Accounting

A build-to-suit (BTS) lease is a contract in construction where the developer builds a property based on specifications set by the lessee. The developer provides financing and maintains ownership while the lessee pays the rent in the lease upon the project’s completion.

If the lessee controls the asset during construction but before the start of the lease, then it is the owner’s for accounting purposes in BTS arrangements. After the construction, the accounting uses SLB guidance. The new guidance of ASC 842 made changes to how lessees determine whether their involvement in development applies to SLB accounting. Before ASC 842, accountants used the construction-period risk to identify ownership of the asset under construction.

Now, the lessee controls the asset under construction before the beginning of the lease if:

- The lessee makes payments on the asset.

- The asset has no alternative use and the lessor requires payment for services to date.

- The lessee owns the asset and improvements.

- The lessee controls the land on which the improvements are made and does not lease it out before construction starts.

Lease Incentive Accounting

Lease incentives, also often called tenant inducements, are contract clauses that encourage renters to enter a contract with a lessor. These include cash payments, build-out allowances or rent holidays such as rent-reduction, a rent-free period or graduated rent payment.

According to Hozza,

“A landlord either provides a free month(s) of rent or pays for various improvements on behalf of the tenant. In both cases, GAAP requires the tenant to record the gross value of these incentives on their balance sheet as an asset depreciated over the shorter of the estimated useful life or the life of the lease. The tenet would also record a liability as deferred rent and written down against a reduction of rent expense.”

Synthetic Lease Accounting

A company uses a special purpose entity (SPE) to hold title to a property and then leases it back from the SPE. A synthetic lease allows the company to get the tax benefits of owning property while keeping the debt off of its balance sheet.

The FASB requires companies to list their SPEs on their balance sheets. However, synthetic leases still provide many benefits to companies, such as decreasing their tax liability. Companies with synthetic leases account for themselves as the lender and the company leasing the space.

NetSuite Can Help Your Company Comply With the New Lease Accounting Standards

The new lease accounting regulations may be challenging initially. Accounting departments that are efficiently adapting to the new standards for revenue recognition for lease accounting realise modern accounting systems help achieve reliable compliance.

Adhering to the new rules doesn’t have to be time-consuming. Once companies determine how to account for their leases, NetSuite can help keep tabs on each lease and even streamline the payment schedule. NetSuite’s financial management solution provides real-time visibility into all of your company’s fixed assets and expedites financial transactions.

Learn more about how NetSuite can help you navigate and adhere to the new lease accounting standards.