Invoice processing involves the complete cycle of receiving a supplier invoice, approving it, establishing a remittance date, paying the invoice, and then recording it in the general ledger. It is a critical aspect of running a business.

When vendor invoices aren’t paid on time, it can interrupt your incoming stream of services, supplies and raw materials and damage your supplier relationships. One or two missed payments may be forgiven, but continued tardiness will hurt your business.

Thanks to advancements in technology, excuses like "the check is in the mail" just don’t cut it anymore when it comes to invoice processing. Your suppliers know that most companies use some type of automated system to receive and record their invoices and put those bills in the payment pipeline.

When your suppliers don’t receive timely payments, they will take action to protect their balance sheets.

What Is Invoice Processing?

The tracking and payment of supplier invoices, invoice processing is the series of steps that take place from the time a supplier invoice is received until it's paid and recorded in the general ledger.

Whether an invoice is received via mail, as a PDF attached to an email, or as an e-invoice, the information it contains must first be manually or automatically scanned into your accounting system. From there, the invoice goes through a specific workflow approval and payment.

Key Takeaways

- Without an efficient invoice processing workflow, bills won’t get paid in a timely manner.

- Check all supplier invoices for accuracy as they are received to ensure that the goods or services being billed have been received.

- Route the invoices to the appropriate approvers prior to scheduling them for payment.

- If there are discrepancies in the amounts charged or quantities received, address them early in the process so bills are not paid incorrectly.

- Once the invoice is paid, it should be entered it into the general ledger.

Invoice Processing Workflow

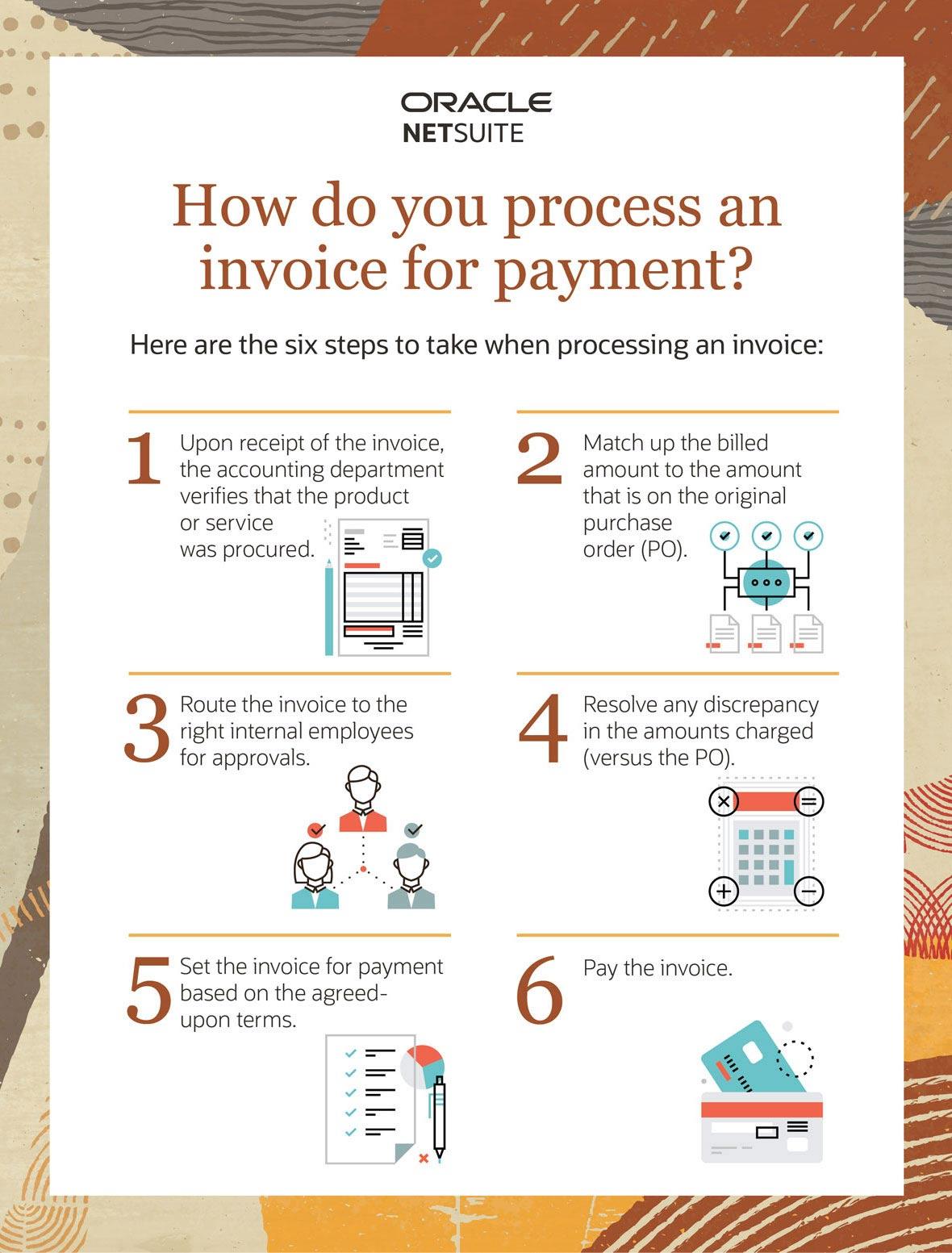

It’s important to establish an efficient invoice processing workflow. At a basic level, this workflow includes:

Invoice Receipt: The accounting department will verify that the product or service was procured. It will then match up the amount billed to the amount on the original purchase order (PO). If there is a discrepancy in the amounts charged (versus the PO), the issue must be resolved with the supplier prior to the invoice being routed for approval.

Invoice Approval: If the information is correct, the invoice is then routed for approval in accordance with company policies.

Invoice Payment: Once approved, the invoice will be set for payment based on the terms that were negotiated with the vendor. In some cases, companies may choose to pay an invoice early in order to take advantage of a discount (e.g., 1% Net 10, or a 1% savings if you pay the bill within 10 days or less).

Having an established invoice processing workflow with make your accounts payable department more efficient as they track what’s owed to suppliers, ensure payments are properly approved and process payments. Accurate information on accounts payables is essential to producing an accurate balance sheet.

When Can an Invoice be Processed?

An invoice can be processed for payment once all of the steps above have been completed and the invoice has been approved and entered into the system.

How Do You Process an Invoice for Payment?

What Is the Journal Entry for Invoice Processing?

Once a vendor invoice is received, it must be entered into your company’s accounting system. Recorded on the balance sheet as a liability, the invoiced amount becomes an accounts payable (AP) and is commonly offset as an expense on the income statement.

How to Enter an Invoice Into the Accounts Payable System in 5 Steps

Use these five easy steps to enter an invoice into the accounts payable system:

- Once the invoice is approved (using the steps outlined above), enter the invoice as a credit in your general ledger’s accounts payable account.

- Once entered, the item is classified as an "open invoice."

- Enter the payment date for the invoice based on the predetermined terms (consider taking any discount opportunities that have been provided).

- Debit the amount to the appropriate accounts (the majority of AP items are recorded as expenses on the income statement, but there are cases where an off-set can be recorded to prepaid assets or fixed assets).

- Once an open invoice has been paid, it is removed from accounts payable with a debit and an offsetting credit to cash.

Top Invoicing

Software

Invoice Processing Automation

Manual invoice processing is time-consuming, expensive, and error-prone. Levvel Research, estimates that 50% of firms have yet to automate their accounts payable processes, while 24% scan and email their invoices and 23% rely on manual processes. The cost associated with these manual processes is steep: where it costs about $10 to manually process an invoice, that expense plummets by 79% to $2.07 per invoice when invoice processing automation software is implemented.

By automating the invoice management process, accounting teams are able to:

- Consistently process vendor invoices faster and more efficiently.

- Avoid losing invoices and the need to search or go back to the vendors for a copy of those documents.

- Eliminate late fees that vendors charge when bills aren't paid on time.

- Take advantage of early payment discounts that many vendors offer in exchange for paying bills within 10-15 days of receipt.

- Eradicate manual data re-entry across multiple systems that takes up time, manpower and effort.

- Support good supplier relationships in a world where the next customer is literally one screen tap or mouse click away.

- Keep the supply chain moving by ensuring vendors are paid and materials/supplies are flowing into your company as expected.

- Focus on more important projects that are core to the business’ success (versus repetitive data-entry tasks).

Invoice Processing Automation Software

Automated invoice processing software allows companies to take a more "hands off" approach to accounts payable management. It also helps free up accounting teams to focus on more important tasks. Key software functionality include standardised coding, automated approval workflows, and dashboards that show which vendors have been paid, what invoices are set for payment and which still need to be approved.

Some invoice processing automation platforms integrate directly with ERP platforms, which helps increase the accuracy and timeliness of payments. By simplifying the accounts payable process, these software platforms help organisations improve their cash management and expedite the financial close process.