For an in-person meeting with a venture capitalist, you need to focus on two things: your pitch deck and presentation style.

It’s worthwhile to brief yourself on what VCs are looking for, so you’ll be in the best position to sell both your business and yourself.

What’s a pitch deck?

A pitch deck is a presentation that provides an overview of your business. The deck can share insights about your product or service, business model, market opportunity, company funding needs and your management team. If you’re hoping to raise money from a VC, a solid pitch deck will be your calling card and the starting point of most introductory meetings.

Winning pitch decks are brief and clear, and they must cover some standard information. In an article for Inc, Mark Suster, a managing partner at Upfront Ventures, says a pitch deck should be visual, compelling and cover the following(opens in a new tab):

- Founding team

- Market pain point, market size and how your product/services alleviates this problem

- Company progress in terms of team, product development, major clients and any revenue

- The amount of money you’re asking for, how that money will be used and what milestones you hope to reach

- Financials, such as P&L statements(opens in a new tab), over 3-5 years

- A clear, long-term vision for your company

There is some debate about whether an entrepreneur should send a pitch deck prior to the actual meeting. For this purpose, Suster recommends having a separate presentation called a teaser deck(opens in a new tab) that you can send to VCs via email during the introduction phase.

A teaser deck is a simplified version of your pitch deck that includes quicker descriptions of the team, market, problem, solution and company progress. (A teaser deck does not include the amount of money being raised, P&L statements, use of proceeds or any other confidential information.)

You can learn more about Suster’s pitch deck strategy in his article for Inc(opens in a new tab). VC heavyweight Sequoia Capital details a similar list of items to include in your pitch deck(opens in a new tab) on its website.

How long should my presentation be?

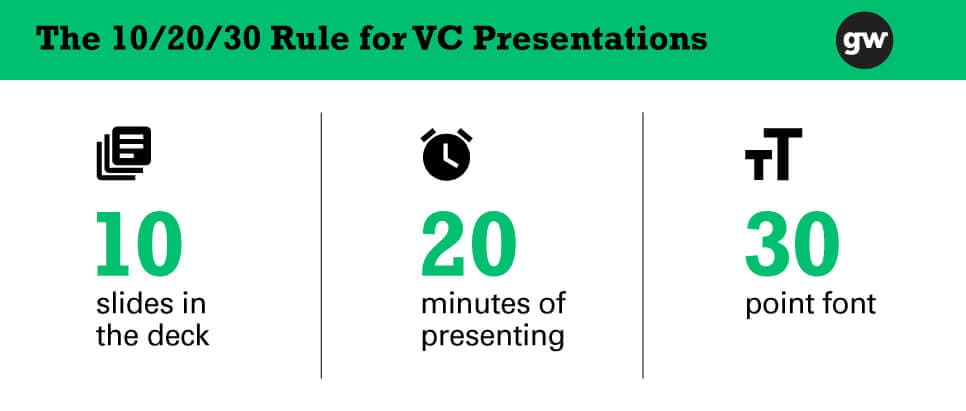

Consider the 10/20/30 Rule.

“A pitch should have 10 slides(opens in a new tab), last no more than 20 minutes, and contain no font smaller than 30 points,” entrepreneur and business author Guy Kawasaki recommends.

The rule isn’t an exact science, but as a bona fide business legend, Kawasaki has crafted and witnessed enough pitches to know what works.

Kawasaki bases his 10-slide recommendation on the idea that the human brain can only process 10 concepts at a time. More concepts will be lost and might even cloud the original concept, he says. So, focus on what’s most important, and boil those slides down to 10.

A typical presentation slot is an hour, but with late arrivals and technical difficulties, it’s best to shorten your pitch to 20 minutes. This guarantees you’ll be able to cover your entire deck and leave time for discussion.

Any font smaller than 30-point leads to information overload on each slide. With too much info, you may feel inclined to read as opposed to present.

Are there pitch deck examples out there?

Wouldn’t it be amazing to see the pitch decks that companies like Airbnb, Square, LinkedIn and YouTube used to get funding? Well, you can. Companies like these often publish their pitch decks as learning tools for other entrepreneurs.

Aaron Lee, co-founder of online retailer Leneys, compiled 30 of the best pitch decks(opens in a new tab) in anarticle for Piktochart. Browsing these professional pitches, you’ll see that Kawasaki’s 10/20/30 rule is not exact but often comes into play.

You’ll also notice the decks each have a distinct style yet also share many characteristics. Some of the most common deck tactics are:

- Hook your audience. Describe your business in simple language that engages your investor.

- Show problem and solution. Paint a picture of the market pinch point, and how your company can solve it. If you’ve got a competitive advantage, let the investors know.

- Highlight the team. If you’re lucky enough to have a seasoned management team, show that.

- Hit em’ with the numbers. If you have key metrics that show business growth such as engagement, traffic or revenue, then put them front and center.

- Find your tone. Know who you are (tone) and who you’re speaking to (audience), and highlight this in the deck.

- Tell a story. Most of our brains prefer stories to sales pitches. If you can share your pitch in the form of a story, investors will be more engaged.

Note: You don’t need all of the elements above to form a great deck. Think about your company offering, and utilize the features that are best for you.

#1 Cloud ERP

Software

The presentation

A pitch deck helps prepare for your VC meeting. But once there, you’ve got to verbally sell yourself. Even if your idea is a winner on paper, a VC team must also have faith in your ability to carry out the plan.

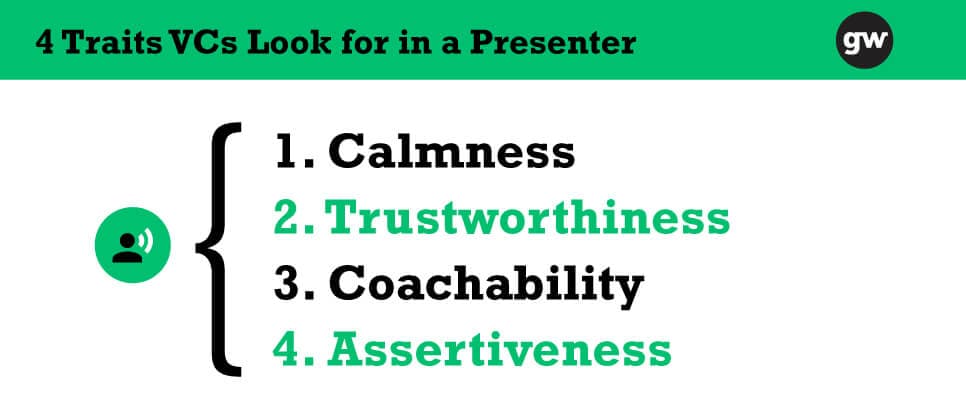

Harvard Business Review author Justyna Stasik breaks down a study conducted by Lakshmi Balachandra(opens in a new tab) on the interaction between VCs, angel investors and entrepreneurs during the pitching process. After extensive research, Balachandra’s study identified four broad conclusions:

1. Calmness tends to beat passion.

In an MIT entrepreneurship competition that used VCs as judges, selected finalists were found to be calm and focused, rather than energetic and passionate.

“The VCs preferred a calm demeanor,” Stasik wrote. “So temper the enthusiasm, and project stone-cold preparedness instead.”

2. Trust is paramount.

Balachandra’s study discovered that investors analyzing a pitch are more concerned with the character and trustworthiness of a founder than perceptions about ability or competency. The study revealed that while survey respondents thought CEOs could learn new skills over time, they believed a person’s character was more difficult to change.

3. Avoid acting like you know it all.

Confidence is one thing, but nobody likes a know-it-all. In Balachandra’s study, investors reacted more positively to pitches in which the founder was open to hearing new ideas. Founders that ranked highly in coachability moved on to the due diligence phase most often.

4. Keep in mind that for better or worse, gender-related characteristics play a role.

The study also looked at how stereotypical emotions for females (warmth, sensitivity, expressiveness and emotionality) and males (forcefulness, dominance, aggressiveness and assertiveness) impacted investment decisions. While gender itself wasn’t a predictor of success, investors in Balachandra’s study were more likely to support founders with stereotypically male behaviors.

When you’re pitching your business to a VC, remember that you’re also selling yourself. Appearing calm, trustworthy, coachable and assertive is the best way to build rapport.

🌱 The bottom line

To secure VC funding, both your business and you must be attractive to investors. The success of any business depends on not only its model but also its founding team. Knowing this truth, VCs will investigate every deal with these two factors in mind.

So, build a concise, engaging deck to get your foot in the door. Then, portray yourself in the best light possible and close it out!