This guide on inventory cost accounting goes beyond simple costing to provide professionals everything they need to choose a method for financial reporting. We provide definitions, formulas, examples, expert advice and comparison charts to help you understand the concepts.

In this article:

- Cost flow assumptions and how to use them

- When to use each inventory costing method

- How to calculate the weighted average cost (WAC)

What Is Inventory Costing?

Inventory costing, also called inventory cost accounting, is when companies assign costs to products. These costs also include incidental fees such as storage, administration and market fluctuation. Generally accepted accounting principles (GAAP) use standardised accounting rules to ensure companies do not overstate these costs.

Inventory costing is a part of inventory control technique. Proper inventory control within a supply chain helps reduce the total inventory costs and assists in determining how much product a company should carry. All this information helps companies decide the needed margins to assign to each product or product type.

Industry expert Steven J. Weil, Ph.D. and President at RMS Accounting discusses inventory costing and tracking inventory in the real world. He says,

“The best way to track shrinkage is still regular physical inventories, to check that what the system is saying is correct.”

“We typically want to cost the stock by departments. Setting similar margins in each department is easier to track. These similar margins show us when there is shrinkage and how much that product is bringing in (and what it could be bringing in).”

To learn more about inventory control, read our “Essential Guide to Inventory Control.”

There are several approaches to cost accounting. These include:

- Standard costing

- Lean accounting

- Activity-based

- Resource consumption

- Throughput

- Marginal costing

Cost of Goods Sold Vs. Inventory

In accounting, the difference in cost of goods sold (COGS) and inventory values are represented by where the accountant records them. Companies value inventory at its cost to them and as a part of their current assets. COGS represents the inventory costs of goods sold to customers.

Accountants record the ending inventory balance as a current asset on the balance sheet. When inventory increases, the assets on the balance sheet increase. When inventory decreases, the assets on the balance sheet also decrease. Accountants also record the change in inventory as a part of the COGS on the income statement.

Instead of showing a change in inventory as a COGS adjustment, accountants adjust some income statements to show the calculation of COGS as:

Companies generally report inventory value at their paid cost. However, a manufacturer would report inventory at the cost to produce the item, including the costs of raw materials, labour and overhead. Usually, inventory is a significant, if not the largest, asset reported on a company’s balance sheet.

Inventory Costing Methods

The method companies use to cost their inventory directly guides the income and inventory value they report on their financial statements. Each company chooses a systematic approach to calculating and reporting its inventory turnover, and regulators expect them to stick to that method every year.

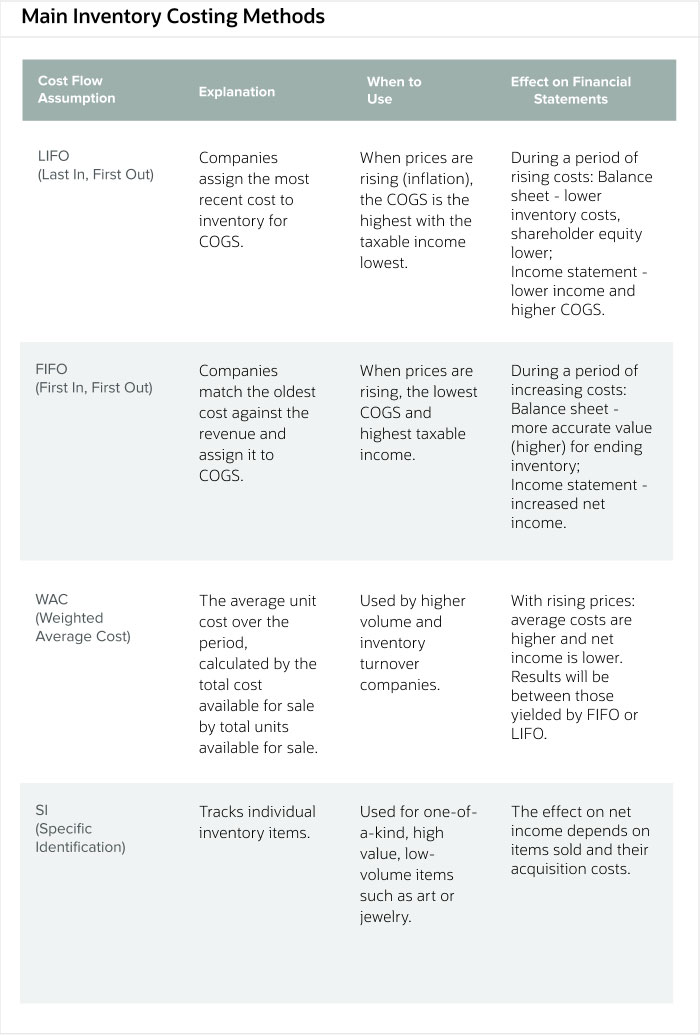

There are four main methods to compute COGS and ending inventory for a period.

- First In, First Out (FIFO):

Companies sell the inventory first that they bought first. - Last In, First Out (LIFO):

Companies sell the inventory first that they bought last. - Weighted Average Cost (WAC):

Companies average the costs of inventory and how much they sell over the period. - Specific Identification:

Not technically a cost-flow method but allowable under GAAP, this option often uses serial numbers to differentiate products and their inventory cost specifically.

GAAP covers FIFO, WAC and Specific Identification. GAAP does not cover LIFO, but it is mentioned above for comparison purposes.

To compare methods, consider the example of Jack’s Furniture and its bookcase sales. Regardless of which cost flow assumption the company uses, the balance sheet for the period starts the same. This journal shows the same beginning inventory, purchase and associated costs:

However, when a customer buys 60 units, the difference in these cost flow assumptions is clear. In FIFO, the ending inventory cost ends up higher to reflect the increase in prices. As a comparison, in LIFO, the ending inventory cost is lower as a reflection of the increasing prices of the bookcase. In the WAC example, the ending inventory cost is in the middle of LIFO and FIFO, showing that the price changed.

If these transactions were the only ones in this period and the sales were $12,000, the income statement and the balance sheet would look like the following:

As noted, specific identification is not technically a cost flow assumption, but it is a technique for costing inventory. In this case, the physical flow of inventory matches the method and is not reliant on timing for cost determination. The use of serial numbers or identification tags accommodate the use of this method and the identification of each item in inventory, capturing when the company bought the item and how much it paid.

Consider an art dealer that specialises in only one product type, handmade globes. An example of his inventory flow follows:

From this information and the information about which specific products the dealer sold over the period, he can calculate the following figures:

Ending inventory and COGS are based on what the dealer sold or did not sell from each specifically identified purchase or beginning inventory. Notice how he separated each purchase based on what he originally paid for them. He knows that customers purchase his handmade items based on which specific ones they prefer, not on the lot he bought them in. The gross profit is period retail sales minus the total spent originally for the specific goods he sold during the period.

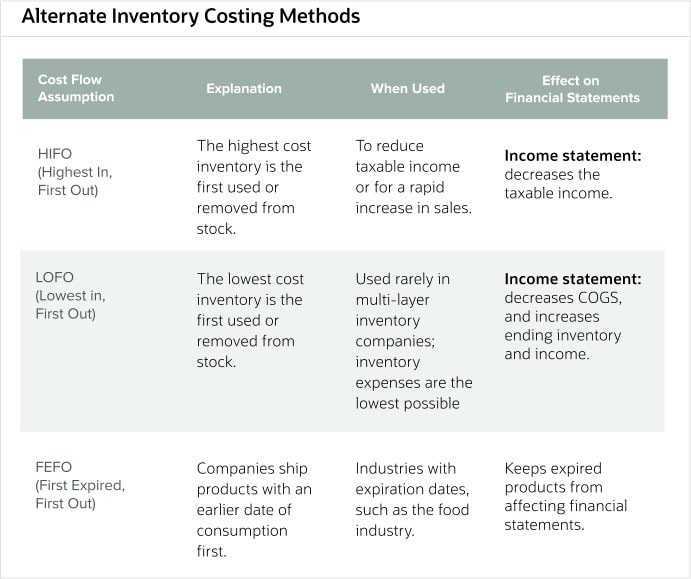

Less mainstream methods not covered under GAAP include:

- Highest In, First Out (HIFO): Companies sell the highest-cost inventory first.

- Lowest In, First Out (LOFO): Companies sell the lowest-cost inventory first.

- First Expired, First Out (FEFO): Companies sell the first-expiring inventory first.

Using the example from above of the bookcases at Jack’s Furniture, the journal starts the same.

The COGS and inventory balance once again change when customers buy 60 units under the HIFO and LOFO methods during a period. The HIFO example removes the highest cost inventory first, leaving less value in stock, and the LOFO example removes the lowest cost inventory first, leaving a higher value in stock.

For the income statement and the balance sheet for $12,000 worth of sales, HIFO and LOFO would compare as the following:

In FEFO, expiration dates drive the sales. For example, if a retailer began with and purchased a total of 80 units and sold 40 units with two different expiration dates, it would look like the following:

The items in stock after the sale have a later expiration date. The company exhausts the stock with the earliest expiration date first.

Inventory Valuation Adjustments and Estimates

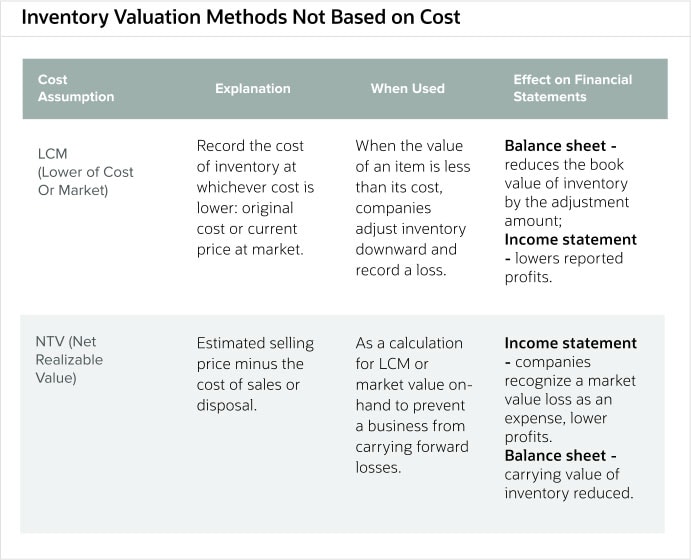

GAAP allows adjustments in inventory valuation when it has an uncertain future, such as when it may become obsolete. Methods for these adjustments include:

- Lower of Cost or Market (LCM):

Companies record the lowest cost, either the purchase price or the price at market, of their inventory. - Net Realisable Value (NRV):

Companies record the estimated selling price, less the cost of their sale or disposal.

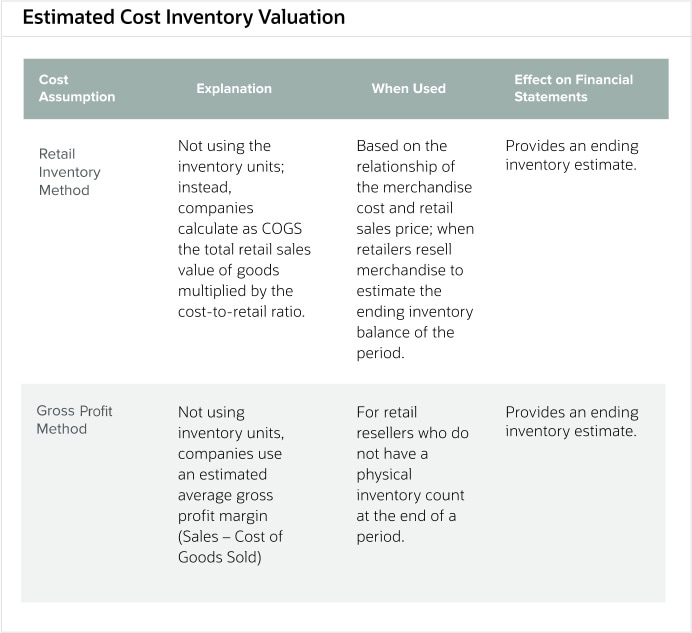

Finally, some methods estimate the cost value of the ending inventory:

- Retail Inventory Method:

Companies calculate the cost of inventory in stock based on the relationship to their retail price. - Gross Profit Method:

Companies calculate their inventory amount and COGS utilising a ratio to sales.

Weighted Average Inventory Costing or Average Cost Inventory Method

The weighted average inventory costing method, also called the average cost inventory method, is one of the GAAP-compliant approaches companies use to value their business stock. This method calculates the per-unit cost using a weighted average for the cost of goods sold and the inventory.

The formula for the weighted average cost method is a per unit calculation. Divide the total cost of goods available for sale by the units available for each inventory item.

For example, Trax is a small business that purchases and sells snowboards. For November, the following shows its purchases and sales:

The ending inventory is the total units available minus the total units sold during the period. In this example, the ending inventory = (200 + 200 + 150 + 300 + 300 + 400) – (100 + 75 + 200 + 300 + 300) = 1550 units purchased – 975 units sold = 575 units remaining.

Calculate the weighted average cost for the snowboards by using the following chart that shows the number of units purchased, the cost for each unit on the date purchased and the total cost paid for the purchase on that day.

The weighted average unit cost based on the chart above for Trax in November was $384,250/1550 = $247.90 per unit.

The cost of goods sold (COGS) valuation is the number of units sold multiplied by the weighted average cost.

The ending inventory valuation is the 575 units remaining multiplied by the weighted average cost.

Together, the COGS and the inventory valuations add up to the actual total cost available for sale.

Inventory Cost Flow Assumptions

An inventory cost flow assumption is the method accountants use to remove their company’s inventory costs and report them as cost of goods sold for accounting valuation. Examples of these assumptions include FIFO, LIFO and WAC.

The cost flow assumptions do not necessarily represent the actual physical flow of goods. They are merely the costs assigned to the company’s inventory units. The main inventory costing methods that are GAAP-compliant are FIFO and WAC. LIFO is also included below for comparison purposes:

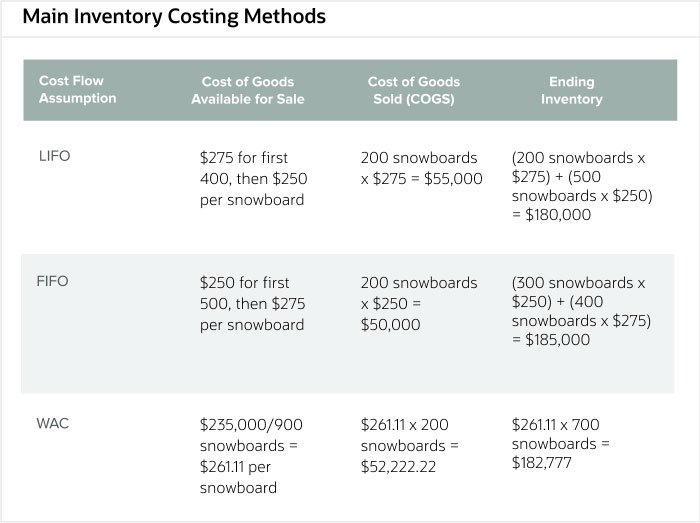

Compare these methods using the Trax sales and purchases of snowboards for January and February:

In January, Trax bought 500 snowboards at $250 each = $125,000.

In February, Trax bought 400 snowboards at $275 each = $110,000.

For the accounting period January-February, Trax had 900 snowboards in stock and sold 200

snowboards.

Accountants would not use the specific identification method in this example because retailers do not track snowboards with unique identification codes. Specific identification would be a good method if the company were selling snowboards that are one-of-a-kind pieces of art or collectibles from famous athletes. In these cases, tracking the physical flow of the goods is easier than in high-volume retail operations. To calculate the ending inventory in the specific identification method, tally the cost of each item in inventory at the end of the period.

The following are three alternate inventory costing methods. GAAP does not approve of these methods, so accountants seldom use them.

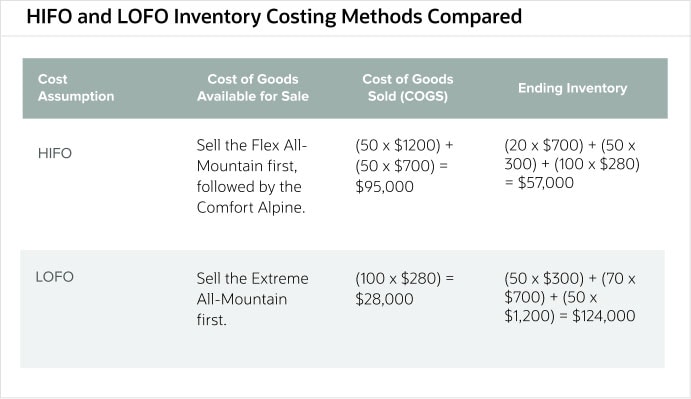

Compare the HIFO and LOFO methods using an example of a different snowboard company, Outward Bound, which sells several different models of snowboards, some more expensive models made by craftsmen and others that factories mass-produced. From this company’s accounting software, costs and quantities of the snowboards in stock are:

Extreme All-Mountain, 100 in stock @ $280 each ($28,000).

Apex Freestyle, 50 in stock @ $300 each ($15,000).

Comfort Alpine, 70 in stock @ $700 each ($49,000).

Flex All-Mountain, 50 in stock @ $1200 each ($60,000).

It sold 100 snowboards in the accounting period.

For an example of FEFO, see the Happy Yogurt Company’s books. It had three batches of yogurt with different quantities and expiration dates.

Happy Greek-style, 1000 in stock @ $2.99, expires Jan. 10, 2020.

Happy

Strawberry-flavoured, 500 in stock @ $2.45, expires Feb. 15, 2020.

Happy Plain-flavoured,

500 in stock @ $2.50, expires March 3, 2020.

It sold 1,200 yoghurt in the accounting

period.

The following are inventory valuation methods not based on cost. GAAP recognises both as valid methods of valuing inventory.

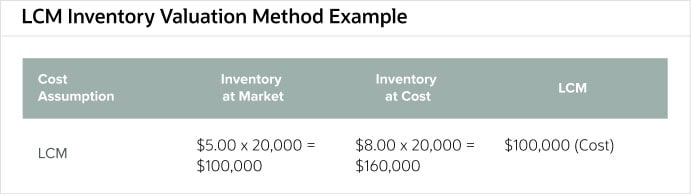

Bob’s General Store got on the bandwagon late for a product known as a “fidget spinner.” Therapists originally developed this toy for children with attention disorders, but it became a fad in 2017 with peak sales in June. By the following September, when Bob’s bought 20,000 @ $8.00 each, many school districts had banned them, and their demand plummeted. The market value of a fidget spinner also fell to $5.00 each.

Based on this information, Bob’s would report its LCM as the market value to be the cost of inventory for fidget spinners.

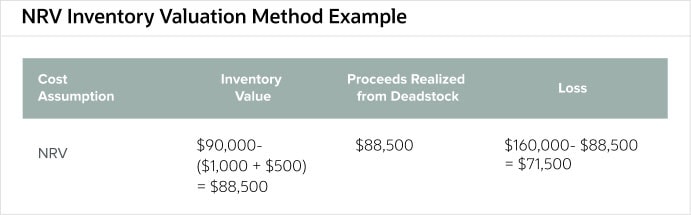

Fearing the product demand would continue to go down, in October, Bob’s General Store received a bid to sell the remainder of the fidget spinner stock for $90,000. Bob paid $1,000 to the agent who found the bidder. Bob also recorded $500 in storage costs.

The net realisable value for Bob’s General Store inventory was $88,500. It also recorded income from the deadstock as $88,500 and a loss of $71,500 for the period.

The following are two methods for estimating ending inventory and thereby the inventory value. As estimates, companies should not expect them to be completely accurate, so they should factor in any loss of stock from damage and theft and supplement them with periodic inventories.

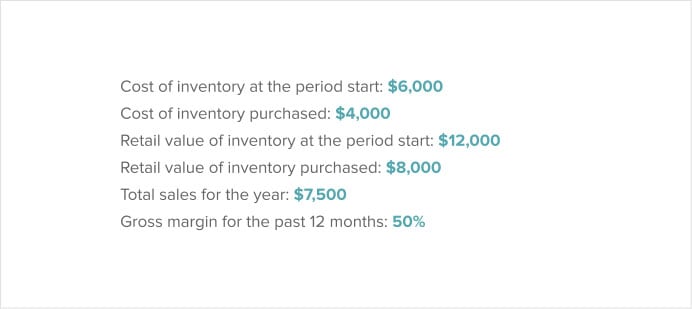

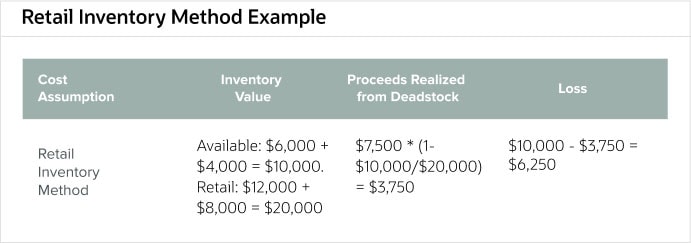

The Pacific Bead Company sells handcrafted beads from local island crafters to retail markets and customers out of its warehouse. From the company’s accounting software, the following is its reporting period information.

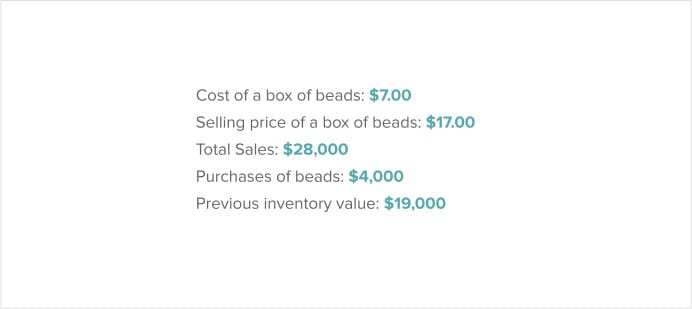

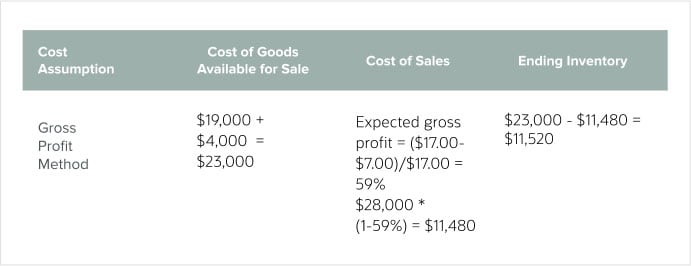

A different bead company in the area, Coastal Beads, Inc., calculated its inventory value at the end of a period using the gross profit method. From its accounting software, it reports the following figures.

How to Choose an Inventory Cost Accounting Method

To choose a cost accounting method, companies should first understand how the different methods will change their balance sheets and income statements. Regardless of the method the company uses, it is most important to use the same method to present numbers year after year.

This principle of consistency, using the same method period after period, enables companies to present the fairest numbers and pay the appropriate taxes based on their reported income. If they want to change their method, they must get approval from the Internal Revenue Service (IRS) via IRS Form 3115 after the end of the tax year. The only requirement when choosing a method is that at the end of the period, the sum of COGS and ending inventory equals the cost of goods available.

Expert Weil shares, “Your accountant can help you decide what method is best for your company. They can make a business recommendation and look at your reconciled data. It is a waste of your money if they are not helping you with tax planning and you only see them annually to file your taxes.”

Each method will have advantages and disadvantages. For example, when a company uses the WAC method with inflation, it would report less COGS than under LIFO but more COGS than if it were using FIFO. Inventory is most up to date under FIFO, as that method uses the most current purchase costs, but understated under LIFO. Under WAC, a company can manipulate its income near the year’s end by how much inventory it buys. Overall though, the averaging process in WAC diminishes the timing effects associated with the purchase of inventory.

Each method will also change slightly based on whether the company uses a periodic or perpetual inventory system. For more information on periodic inventory systems, read “Periodic Inventory: Is It the Right Choice?” Learn more about perpetual inventory systems by reading “The Definitive Guide to Perpetual Inventory.” This change is due to the timing of the calculations performed in the different systems. For example, a WAC method in a perpetual system produces a weighted average system for each sale. Using the WAC method in a periodic system, the company only performs the calculations at the end of a period, taking into account everything that happened and keeping prices more consistent over the period.

Another example is LIFO. There are different ending inventory and COGS for perpetual versus only yearly periodic systems. If companies apply LIFO in a perpetual system, they need to use special adjustments to take advantage of using the LIFO method for tax accounting.

Inventoriable Costs

Inventoriable costs are those that are part of the total cost of a product. These costs include everything necessary to get items into inventory and ready for sale. For example, this can include raw materials, labour, manufacturing overhead, freight-in, certain administrative costs and storage.

Accountants usually record inventoriable costs as assets on the balance sheet. Eventually, the accountants charge them as expenses, and they move them from the balance sheet to the costs of goods sold in the income statement.

The costs accountants consider inventoriable are different in various industries. These inventoriable costs usually fall into three categories of expense: ordering costs, holding costs and administrative costs. Ordering costs are figures that accountants typically allocate to the overhead cost centre because they comprise the procurement department’s payroll, benefits and activities such as pre-qualification of suppliers. Holding costs are what companies pay to store goods that they have not sold, and accountants can include them in the overhead cost centre.

Administrative costs are expenses often associated with the accounting department, such as wages and benefits. Such personnel produce data on the cost of goods sold and inventory on-hand, respond to auditors and fulfil other accounting analysis requests relating to inventory. There may be administrative costs for these functions spread out through several departments, including purchasing and inventory control, as well as accounting.

Inventory Holding Cost

Inventory holding costs, or carrying costs, are those related to storing unsold inventory. Costs include storage space, handling the stock, the loss to the company if the items become obsolescent or deteriorated and the capital cost relating to unsold inventory.

The cost of the storage space is for the facility that houses the stock and includes depreciation, utility costs, insurance and staff. The cost of handling the stock consists of efforts to put the stock into storage, required maintenance and handling equipment and security. Obsolescence is when stock is no longer useful or becomes outdated. Companies must dispose of this stock at a reduced cost or no cost. The capital costs often have interest fees associated with inventorying of stock prior to sale.

Inventory Carrying Cost Formula

There are different ways to calculate holding costs, such as leveraging a percentage of your inventory value. The best way, however, is for companies to add up their known holding costs and divide the sum by their inventory value, giving them a percentage for future use.

As an exercise, companies should itemise their specific costs. Inventory carrying costs should include:

- Cost of capital

- Costs of freight

- Storage costs

- Labor costs

- Cost of insurance and replacement

- Opportunity costs

- Any obsolete, dead or stolen stock

Different industries have different standard estimates for this calculation, such as 2% for storage costs and 15% for capital costs. Companies do not include these costs in inventory accounts, but they expense them as they incur them. Consideration of these costs is essential to ensure profit margins are sufficient to cover them.

Inventory Cost Formula

The inventory cost formula is important because it directly affects the company’s profit. This formula uses the beginning inventory value, ending inventory value and purchase costs over the period. Calculate inventory cost by adding the beginning inventory to inventory purchases and subtracting the ending inventory.

For example, the company values inventory at the start of the period at $50,000. It purchases $15,000 over the period. The value of the inventory at the end of the period is $25,000. The inventory cost for that period is ($50,000 + $15,000) – $25,000 = $40,000.

This basic formula takes into account all the inventoriable costs required to get and keep items for sale and bears on income determination. Any adjustment to inventory causes changes in the reported income.

Standard Cost Inventory

Standard costing is when companies assign the expected (or standard) costs of material, labour and overhead to inventory, rather than the actual costs. This management tool helps to plan budgets, manage and control costs and determine how successfully a company controls cost.

Standard cost inventory comes from the company’s historical data and reflects operations under normal circumstances. Companies use these costs targets in planning. A variance is the difference between the standard (target) cost and the actual cost. When negative variances occur, management must take action by identifying the root cause, improving its operations and potentially making changes to the standard cost.

Companies that use standard costing systems usually produce variance reports to show the differences between the standard and actual costs. In the manufacturing environment, the materials price variance is the difference between the budgeted and actual cost for materials. The formula for materials price variance is the following:

As an example, a manufacturing company of automotive parts budgets $348,500 (standard cost) for 20,500 (standard quantity) of the main material for its popular high-performance oil filters for the year. The standard price per unit is $17.

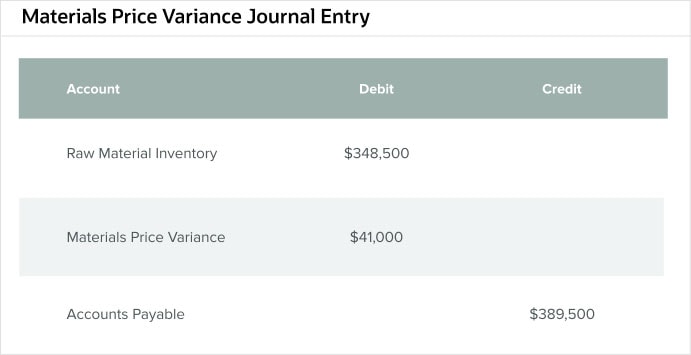

In the journal entries that report variances, the money accounted for was the money spent, and the performance report showed the actual cost of materials for this part was $389,500 (actual cost) for 20,500 of the raw material (actual quantity). The actual price per unit is $19. The variance—whether a credit or a debit—is to the Materials Price Variance account.

Using the formula, the materials price variance = ($19 – $17) x 20,500 = $41,000.

The journal entry for this formula is as follows:

Cost of Ending Inventory

The cost of ending inventory is the value of what is leftover in stock and available for sale at the end of a period. The basic calculation for ending inventory is the beginning inventory plus any purchases minus the cost of goods sold.

The cost of ending inventory can change based on the cost flow assumption the company chooses to use. The goods that companies sell first and their relative costs when purchased affect the cost of what is leftover in inventory, as do the assumptions behind any estimates.

A basic example calculating ending inventory is for Goods, Ltd. This company started its production month with a beginning inventory of $100,000. It purchased $25,000 worth of inventory during the month and sold $75,000 worth of inventory that same month. It calculated the ending inventory as follows:

NetSuite Software for Managing Inventory Cost Accounting

Business owners understand the importance of maintaining accurate inventory records and the role these records play in inventory cost accounting. Find the right tool that can streamline accounting processes and provide visibility into inventory on-hand. Companies using accounting software like NetSuite and inventory cost account methods can better understand the health of their businesses, which in turn allows them to better execute their business and marketing strategies.

Learn more about how you can use NetSuite to manage your company’s finances.